How a Musician Turned Accountant Builds a No-Chase Payment System

Industry

Accounting and Bookkeeping

Challenge

Manual payments and unreliable international platforms like Stripe slowed cash flow and added risk for Anthony’s creative clients.

Results

With Pinch, Amplify 11 automated billing for over 100 clients, eliminated the need for an AR team, and now enjoys predictable cash flow with real-time support and seamless Xero integration.

Key Product

Pre-Approval, Automatic Reconciliation, Payment Plans, Xero Integration

Amplify 11 doesn’t have any accounts receivable department because we don’t need one. Pinch is taking care of all that. It works. It never breaks.

Anthony de Filippis

Amplify11

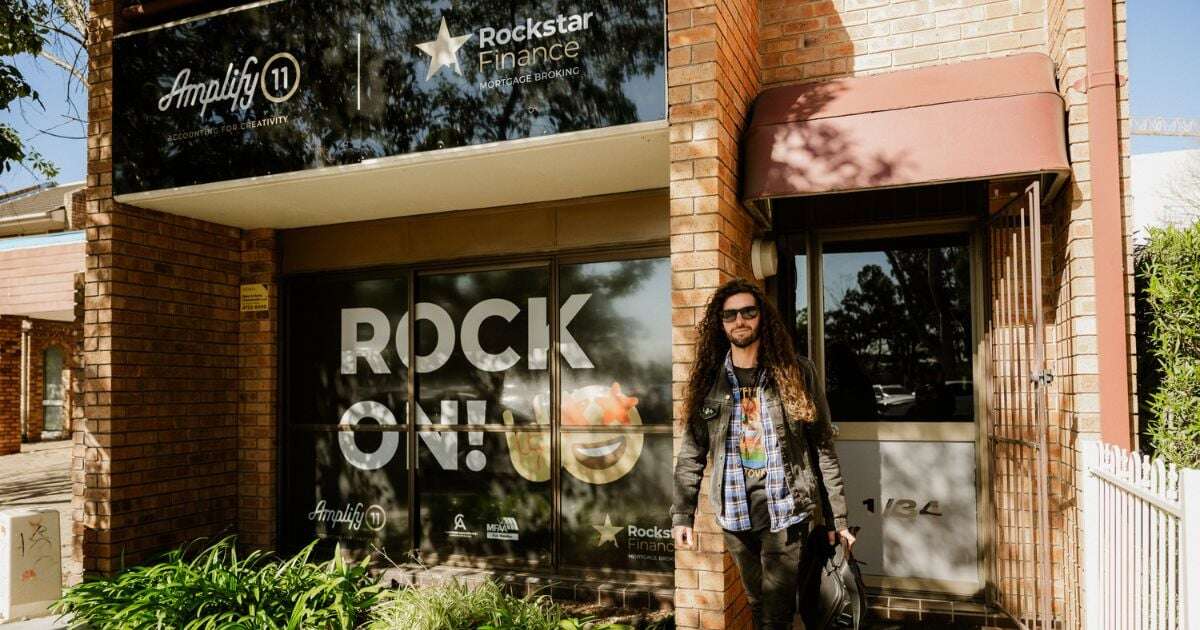

The Client: Accounting That Understands Creatives

Amplify11 was born in 2020, right as COVID lockdowns disrupted the music and arts industries. A musician before he was an accountant, Anthony saw friends and colleagues struggling to navigate government grants, JobKeeper rules, and tax requirements. What began as one-on-one help turned into a business with purpose.

Today, Amplify11 serves a wider network of creative professionals—from filmmakers to advertising agencies—while staying anchored in the culture and values of the music community.

The Challenge: Manual Payments and Unnecessary Risk

“You're expecting $5,000 in collections, which is now gonna be pushed out to a minimum of seven days once you get support and upload your supporting docs… you're now bringing risk into your collections.”

In the early days of the firm, payments were made via manual bank transfers. Clients received invoices and had to check due dates, enter the right amount, copy BSBs, and log into their online banking just to pay. Anthony knew this was slowing down collections and putting his firm—and his clients—at risk.

Even when he explored platforms like Stripe and PayPal, he ran into new problems. He cited stories from his network about frozen accounts and delays in receiving funds, often due to small flags or administrative hiccups.

Because these platforms were international, local support was slow and difficult to reach—leaving businesses without access to expected cash for days.

The Solution: One Platform, Full Automation

Anthony discovered Pinch through Xero’s marketplace. What stood out immediately was that Pinch was local—Australian-owned, with real humans in the same time zone. He mentioned how even during ID checks for AML/CTF, he could just call back a Brisbane-based number to complete the process instantly.

Amplify11 now uses Pinch to manage fixed monthly packages for over 100 clients. Invoices are issued from Xero on the first of each month, and every client is on a pre-approval direct debit plan. Payments are collected automatically the next day, regardless of weekends or holidays.

If there are insufficient funds, Pinch handles the retries and client communication, without Anthony needing to get involved.

“Amplify11 doesn’t have any accounts receivable department because we don’t need one. Pinch is taking care of all that. It works. It never breaks.”

The Result: Reliable Cash Flow, Real-Time Support, and Happier Clients

“Invoice goes out, due date hits, and it just gets debited. I don’t have to chase. My clients see that, and they get it.”

Thanks to Pinch, Anthony knows exactly when money will hit his account each month. There are no surprises, no follow-ups, and no awkward phone calls to chase unpaid invoices. Pinch’s real-time dashboard also gives full visibility of settlements, fees, and invoice links—which feeds directly into Xero without needing to cash-code transactions manually.

He compared this to Stripe, where clients often download a bulk settlement file with no clear invoice breakdown, making bookkeeping slow and messy.

Anthony now uses his own business as a case study when recommending Pinch to others. Clients see how effortless his billing is—and they want the same.

The Experience: A Community and a Partnership

“They’ve built something amazing and they actually care about what they do. That says a lot—not just about the product but the culture.”

Anthony values Pinch not just for the product, but for the people. From support tickets resolved in under two hours, to quarterly community events and partner check-ins, the relationship feels genuine.

He mentioned support reps like Cameron and long-term partnerships with team members like Joe, which contrast sharply with the anonymous, rotating contacts at larger international platforms. Pinch’s referral program also offsets the fees he chooses to absorb for clients paying via direct debit.

Anthony built Amplify11 for a creative community. Pinch powers the payments behind it—quietly, reliably, and without disruption.