| Pricing |

|

|

|

|---|---|---|---|

| Per Transaction Fee | |||

|

not offered | 1.95% + 30c | |

|

1.00% + 40c capped at $4 + an additional fee of 0.3% for payments over $3,000. |

1.00% + 30c capped at $5 |

|

| Integrations | |||

| Xero | check | check | |

| QuickBooks | close | check | |

| MYOB | close | check | |

| Open API | check | check | |

| Support and service | |||

| Pre-sales help and advice | check | check | |

| Free guided onboarding | close | check | |

| Friendly Australian support | close | check | |

| Dedicated developer support | close | check | |

| Features/Attributes | |||

| Online credit card payments | close | check | |

| Online direct debit payments | check | check | |

| Card tokenisation and credit card auto-payment | close | check | |

| In person / phone payment terminal | close | check | |

| PCI compliance | close | check | |

| Multi-invoice / Batch Payments | close | check | |

| Invoice breakdown payment plans | close | check | |

| Customer payment portal | close | check | |

| On-charge fees | close | check | |

| Free custom checkout experience | close |

check | |

| International payments | check | close | |

Support for direct debit and credit card payments

Pinch has the added benefit of being able to support online direct debit payments as well as credit cards.

With Pinch, your customers will have more options on how they want to pay. Plus, you can choose to pass the transaction fee to your customers.

- Online credit card payments

- Securely accept direct debit payments online

- Choose to on-charge fees

A partner that works with your partners

Every business has its own accounting software, and your payment platform should connect with your payments tool of choice.

Both Pinch and GoCardles integrate with Xero, but Pinch is the only platform of the two that talks to Quickbooks, MYOB, DEAR Systems. Plus, Pinch offers a unique two-way sync at no additional charge which means you always know where you stand.

- Seamless integration with leading accounting software

- Open API — the only limit is your imagination

- Two-way sync with Xero, QuickBooks and MYOB

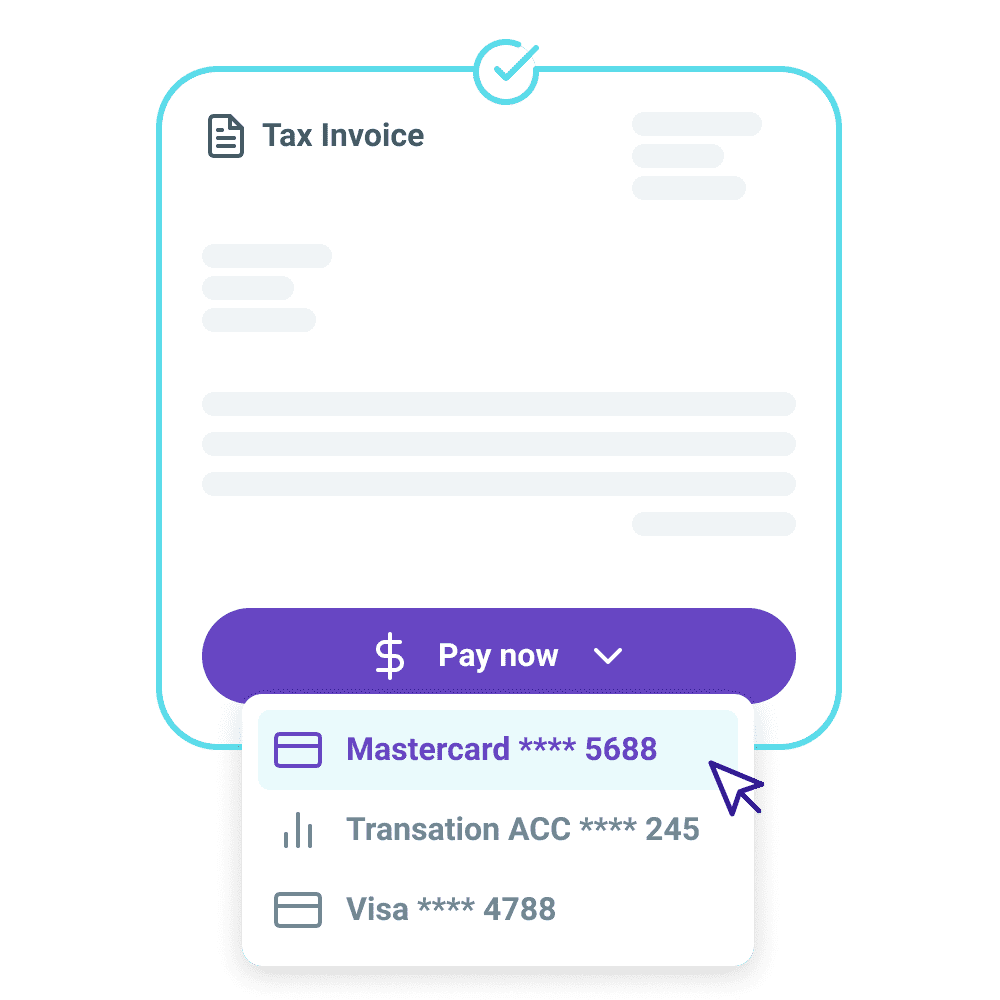

Give your customers more choice over how they pay

Have clients that need to pay multiple invoices or break down big invoices into batches? Want to offer payment plans?

Your payments, your choice. Unlike Stripe, your customers have their choice of ways to pay with Pinch. Improve cash flow and give customers even more flexibility with batch payments, instalments, or by offering payment plans.

- Support for multi-invoice or batch payments

- Set up instalment payments or payment plans

- Automated variable invoice payments

Just a few more of our happy customers

Discover how countless businesses are streamlining their payments with Pinch.

Contact our Australian support team. To figure out if we're the right solution for you, book a sales call.

What next?

Easily integrate with major accounting software or contact us for direct integration. No setup, minimum or monthly fees!