The economic impact of late payment is something that is not spoken about enough. In other parts of the world the government have stepped in and created proper rules and regulations to benefit small businesses, particularly around issues such as fairness when dealing with larger businesses, but in Australia we still operate as a wild west frontier when it comes to this critical economic issue.

Late Payment Is a Big Issue

It goes without saying that late payment makes life tough for small business owners. Not being able to operate knowing your invoices are going to get paid adds stress to an already stressful existence. Furthermore, not knowing you are going to get paid on time makes it difficult to invest in riskier growth decisions like hiring, systems upgrades and marketing investment. But there is more to it, with much of the data leading to indicate that there are correlations between late payment and economic growth, and even cost of living.

Current Research Findings

A number of institutions have provided data to measure the impact and the numbers are shocking, particularly given how little seems to be being done about it at the institutional level.

AlphaBeta Advisors on behalf of Xero released a report in March 2023 titled "Paying the Price: the Economic Impact of Big Businesses Paying Australian Small Businesses Late" in which they determined that Australian SMBs are regularly paid up to 53% of the time when invoicing larger businesses. It was described as a "systemic problem" and estimated the national value of large business late payment at $115 billion a year. The author also suggested that these longer payment times are likely to have a trickle down effect when it comes to those suppliers paying their own bills and surmised that if large businesses were to pay their invoices on time to smaller ones it could deliver a benefit to small businesses of $4.38 billion dollars over ten years as it would reduce their financing costs and encourage them to spend more willingly on things like hiring and business improvement.

The numbers differ from study to study, but there are no studies that indicate that this is not an issue and most indicate that it has only gotten worse. A report in 2017 by Plum Consulting had the total late payment across all businesses to be $50 billion, so you can see that between 2017 and 2022 the rate of late payment has at least more than doubled.

Before you stop to assume that this issue is normal, it isn't. Our payment times lag well behind our counterparts in the UK and the USA, with our invoices getting paid somewhere between 23 and 35 days overdue depending on the study and industry, whereas in the UK and US they generally have their invoices paid no more than a week late.

Given that these large businesses are generally already mandating 30, 60 and in some cases 90 day payment terms on their small business suppliers, the time that they are taking to get paid for product or service delivery can be extremely challenging to navigate.

Industries Most Affected

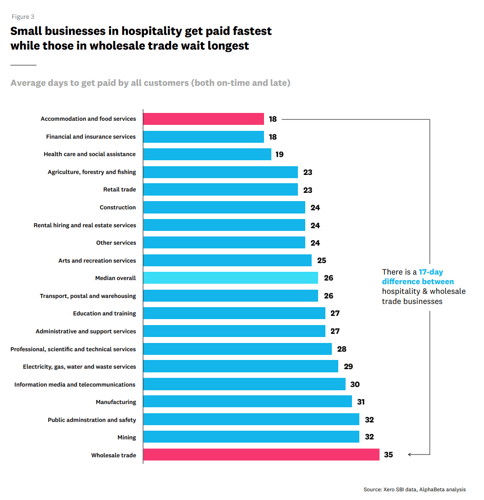

According to Illion's economic snapshot agriculture, health, retail and education sectors are some of the hardest hit, placing pressure on some of our most critical industries. AlphaBeta's Xero driven study, which focuses more on the customer segments Xero operates in supplied a graphic declaring wholesalers the hardest hit with an incredible 35 day wait past the point of invoice due date. This makes sense when you consider where wholesalers sit within the supply chain.

The wholesaler supplies the retailer, who then pays the wholesaler when the retailer moves the goods. But what if the retailer doesn't move the goods? Or they just have a bad week, month, year? The upwards pressure on the wholesaling industry forces them to charge more to account for potential non payment. Envision the impact that then has on the cost of goods across the board? We have heard stories from our wholesale customers of having to wipe tens of thousands off the board when small cafes close, and this is happening across the wholesale space.

Other industries that are consistently hard hit are service businesses in the B2B realm such as IT companies, marketing consultancies and professional services.

Consequences of Late Payments on Small Businesses

Late payments can severely impact the survival of small Australian businesses. Challenges with cash flow can arise quickly, making it difficult for businesses to cover their expenses and potentially leading to financial instability or even closure.

Furthermore, delayed payments can strain relationships between small businesses and their clients. Trust and communication are vital in any business relationship, and unpaid invoices can create tension and mistrust, affecting not only the current transaction but also future collaboration opportunities.

We consistently see that when businesses utilise our platform to automate their invoice payments they begin to experience growth, so it's fair to say that there is also a correlation between issues getting payment and business revenue growth.

Mental Health and Stress

H&R block report that the #1 issue that plagues most small business owners is access to cash for growth. In mid 2023 I presented as part of a panel of "Mumpreneurs" for Mums and Co. and we discussed some of these issues. The issue of "imposter syndrome" reared its head, with some attendees vocalising how not getting paid for the work they do makes them question their own value. In the early stages of small business development on time payments are crucial not only for business health but also mental health and gaining confidence in your self worth and confidence in your business.

Solutions to Late Payment

To address the economic impact of delayed invoices, it is essential to consider policy recommendations. Government initiatives can play a crucial role in addressing this issue by implementing regulations that ensure timely payments and penalties for late payments. Countries around the world have developed government policies to benefit small businesses in this way as they have assessed it as an underlying issue. The European Union have an established late payment directive in 2011 and are presently revising it. They established this specifically because they identified that the entire European economy was negatively affected by late payment. While Australia does have policies to govern themselves paying suppliers, we have no such directive at the federal or state level. If you are feeling frisky here's a great tool to help you contact your local MP and see what they have to say about it.

In the wholesaling space there has been an increase in supplier credit checking, with platforms like CreditorWatch offering businesses the ability to analyse their prospective customers likelihood to pay by aggregating payment times across the market and sharing the data with their customers. This helps them make an informed choice on whether or not to issue them trade credit.

Many small businesses turn to technology solutions such as automated invoicing systems and payment tracking tools, which can streamline the invoicing process and help prevent delays. By leveraging these tools, businesses can expedite payment processes, reduce administrative burdens, and enhance overall efficiency in managing outstanding invoices.

Looking ahead, trends in digital payments are reshaping the landscape of invoice payments in Australia. The transition to digital solutions not only offers convenience and speed but also improves transparency and security in financial transactions. Building trust and fostering transparent communication with clients are crucial elements in ensuring timely invoice payments and maintaining healthy business relationships in the long term.