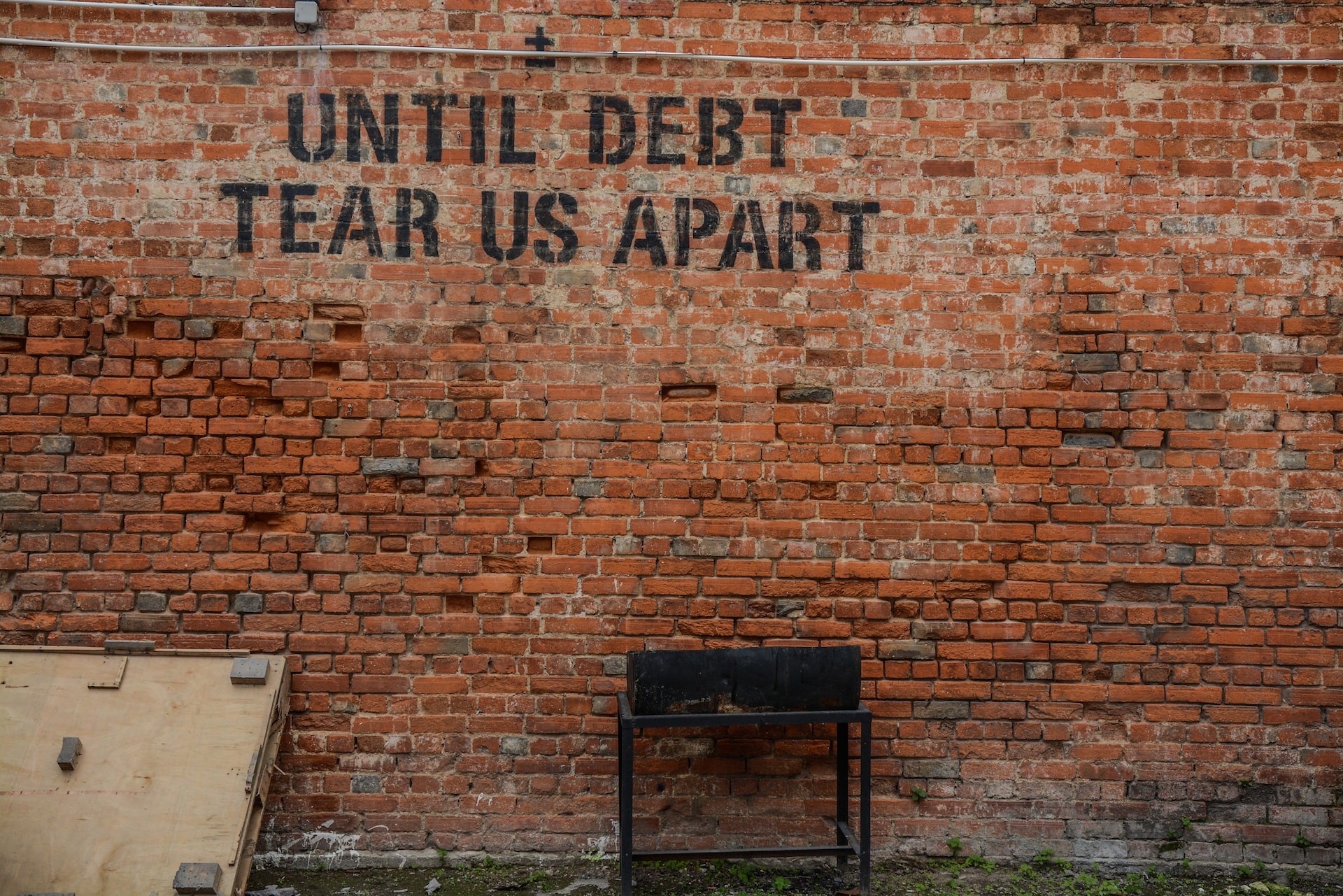

Drawbacks of Debt Collection Agencies in Australia

In this blog post, we'll delve into the limitations of using debt collection agencies in Australia and highlight a more efficient alternative – Pinch Payments, a cutting-edge solution that can revolutionise your invoicing and payment processes.

Costly Fees

One of the most significant drawbacks of using debt collection agencies is the cost associated with their services. These agencies charge hefty fees, often a percentage of the collected debt, which can eat into your company's profits. Small businesses, in particular, may find these fees burdensome, making debt collection an expensive solution.

Lengthy Recovery Process

Debt collection agencies do not guarantee quick results. The process of recovering debts through these agencies can be prolonged, taking several months, if not longer. This delay can disrupt your cash flow and hinder your ability to invest in growth opportunities for your business.

Potential Damage to Client Relationships

When a debt collection agency gets involved, it can strain your relationships with clients. Your clients might feel uncomfortable or offended by the involvement of a third party in the collection process, which could damage the long-term rapport you've built.

Legal Compliance Challenges

Navigating the legal landscape of debt collection in Australia can be complex. Debt collection agencies must adhere to strict guidelines and regulations, and any misstep can lead to legal trouble for your business. Ensuring compliance can be a time-consuming and daunting task.

A Smarter Alternative: Pinch Payments

So, what's the solution to these challenges? Pinch Payments offers a smarter alternative that can streamline your invoicing and payment processes, making debt collection agencies unnecessary. This innovative Pre-Approval platform allows you to store customer payment details securely and seamlessly integrates with popular invoicing systems like Xero, QuickBooks, and MYOB.

Here are some key features of Pinch Payments:

Automatic Payments

With Pinch Payments, every invoice you send can be set up for automatic payment. This means that you can significantly reduce the occurrence of overdue payments, ensuring a consistent and predictable cash flow for your business.

Payment Plans

Pinch Payments allows you to set up flexible payment plans, providing your customers with the option to pay invoices in smaller, manageable installments. This flexibility can enhance customer satisfaction and reduce the likelihood of unpaid invoices.

Surcharge Options

In addition to automatic payments and payment plans, Pinch Payments lets you add surcharges to invoices, covering processing fees and making the payment process more sustainable for your business.

The Pinch API - Collect Payments in Your Own Software

A growing number of Australian software companies are choosing to align with Pinch to manage the collection of payments in their own software platforms. Pinch offers a uniquely hands on process, with complimentary payments' consultation as part of the service. Our API has been described as world class and bulletproof.

Conclusion

While debt collection agencies have traditionally been used to recover outstanding debts in Australia, they come with significant drawbacks, including high costs, extended recovery times, potential damage to client relationships, and legal compliance challenges. In contrast, Pinch Payments Suite offers a modern, cost-effective, and efficient alternative.

By utilizing Pinch Payments, you can eliminate overdue payments entirely, streamline your invoicing process, and provide your customers with flexible payment options.

It's time to bid farewell to the hassles of debt collection agencies and embrace the future of seamless invoice management. Make the smart choice and consider implementing Pinch Payments Suite to optimize your financial operations. Your business and your clients will thank you for it.

Pinch has no setup costs, no ongoing software fees and you can cancel any time. The only fees you pay are transaction fees which you can surcharge at your discretion. Schedule a demo today.

Ready to automate your payments?

Posted by Admin on 18 November 2023