Why be a payments facilitator / TPP?

If you operate a software service that handles invoices or payments in general and do not process those payments directly, you could be missing out on a large revenue opportunity and significant increase to your company valuation. Historically, becoming a payments facilitator is time consuming and expensive. Enter Pinch...

Monetise payments

Pay interchange ++ rates and partner directly with an acquirer

Easily collect payments from credit cards without having to worry about PCI compliance or storing sensitive data. Monetise every payment processed through your software. Work with an acquirer and cut out the middleman.

What are interchange ++ rates? It refers to the costs paid directly to issuing banks and the card schemes (Visa, Mastercard, AMEX). It's a technical term for wholesale (cheaper) rates than what you would pay someone like Stripe.

Control fee schedules

Be in control of how much you charge your clients for payments

When monetising payments in your application, it's important to be able to negotiate with larger clients and set custom fee schedules. When using a third party payments provider this is very difficult. As a payments facilitator it's your choice.

With Pinch, it's as easy as entering rates for a client and hitting save. You can even create hierarchical fee structures when deploying large numbers of clients.

Increase value

Businesses that operate as payment facilitators are worth more

As a payments facilitator, you own your merchant data and are considered the merchant on record. If you use a third party payments processor, they own the data. By owning the data, your company is more valuable.

Why use Pinch?

Pinch operates a "payfac as a service" platform, meaning we do the heavy lifting of integrating with your acquirer as well as performing the operations required to manage your payment facilitator facility on a day to day basis.

We operate our own payfac

We've been processing payments for merchants for 6 years

Pinch operates as a payments platform for SME's across Australia and has built it's internal platform to manage this over the last 6 years. We can help advise, work with acquirers and provide our expertise to help you succeed.

Join an ecosystem

We partner with leading fintech companies to reduce the cost and time to market

We have relationships with leading acquirers as well as fraud detection systems, KYC and onboarding platforms and credit check systems. By working with Pinch, you will gain access to the same ecosystem to save time and money when becoming a payments facilitator.

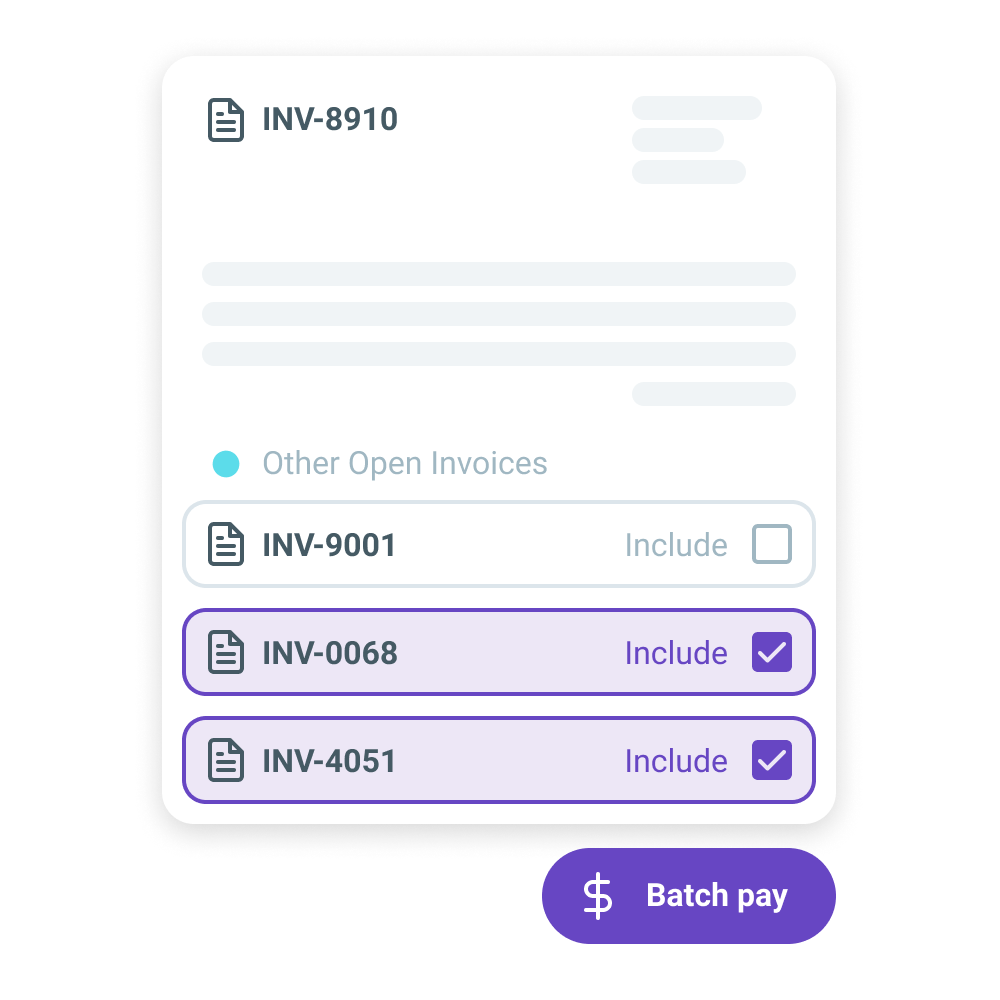

Integrated onboarding / KYC

Compliance and onboarding out of the box

You have the choice of using our API's to onboard merchants, therefore staying 100% in control of the user experience or using our white labelled merchant onboarding forms. Either way, our team of experts will help you provide the best and most secure onboarding experience possible.

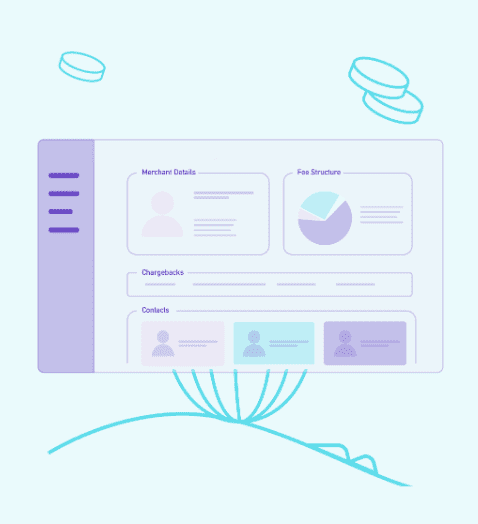

Merchant CRM

A centralised place to manage the relationship between you and your merchants

This is the place to approve merchants to process transactions, enable / disable payment methods, set payment limits, track onboarding progress, view transactional history including data on disputes and refunds. You can also connect your MMS to Salesforce or HubSpot.

Merchant fee management

Granular control over the fees you charge each merchant

Easily configure custom fee schedules for a variety of rails (Direct Entry, cards, NPP) for each merchant or hierarchy of merchants. You can configure blended rates based on card scheme and funding source (different pricing for debit vs credit cards for example). You also have the ability to offer surcharge facilities meaning the end card holder pays the transaction fee and not your merchant.

An API first platform

Everything you can do in our portal, you can do yourself via the API

We are a software development company and are led by software engineers. Our API provides all the information required to manage a payments facilitator which means you can be in complete control of the user and admin experience. You get access to software engineers to speak / have Zoom meetings with your implementation team.

Looking for a slide deck to distribute to colleagues?

View the presentation with download option and further information and how you can get in contact with us.

What our SME customers are saying

“It’s set and forget in the sense that once you onboard a client, that's it. You don't have to worry about sending an invoice again. It's just all done and dusted and it just takes away like any kind of extra people touching it or needing reminders. Before Pinch, it was always us chasing clients. Now the process is automated: we know the contract is signed, we know the payments have been audited. And then as soon as that's all done, they're put straight into our project management system. It basically minimises any room for errors, and minimises time spent chasing up and seeing where things are at.”

Kady, Kady Creative

"Pinch is an integral partner in our business. Every time I see a Pinch line on our statements, I know that it represents a lot of manual work that we’re just not doing anymore. As well as making our lives easier, it actually makes the customer journey a lot easier aswell. They just have to click a button, put their card in once, and then it’s done. We’re also saving time for them in terms of theiraccounting and processing, because it’s happening automatically for them as well.

Sarah, AiRE

Gosh have just signed up with Pinch Perfect and can't believe how easy it is to setup so I can offer clients a variety of payment options...highly recommend!

Kate

It has been incredibly easy to integrate Pinch into our business and our customers have loved the flexibility to pay during hours that suit them. Pinch has made reconciliation of credit card transactions a breeze. Quick and efficient and saves a lot of time.

Nicola, OZ Excavator Buckets

Forced into looking for a change by a sudden decision by the existing provider to charge a minimum monthly fee which was 4 times what I had been paying I found and implemented Pinch. Super easy to set up and no hidebound bureaucracy such as encountered from banks. Have been using Pinch for 6 weeks and no issues to date. Particularly like the way it collects monthly subscriptions without any interaction from me. Data flows to Xero accurately and in a timely way. Would thoroughly recommend.

Stella, 1 to 1 Mobile Computer Training

The team at Pinch have been amazing and I couldn't recommend them more highly. Paul and Bill have been great in helping me setup the payments system and integrate it into my business. Always available to help and quick to pick up the phone. Thanks Pinch

David, StudentPay

Bloody love pinch! Its so simple to use and was so easy to set up. Bill and the team honestly go above and beyond and have tackled any questions or scenarios I have thrown at them. As a bookkeeper I will only be using Pinch going forward for myself and my clients.

Summer, Oh Nine Solutions

We have recently signed up with Pinch and can't believe how easy and efficiently it integrated with Xero accounts. Also love the auto-reconcile of payment fees. Pinch also makes it very easy for our clients to pay their bills. Thank you Blake for all your help. We would definitely recommend Pinch!

Valerie, Infinite Print

We've tried and tested out dozens of payment solutions over the years at Digit both with our business, and in helping other businesses move to digital payments. The team at Pinch have been amazing at finding technical solutions to meet bespoke needs. They've helped us leverage their Xero capabilities for variable billing, combined with the ability to push in through their API payer details when people sign our agreements. They're the perfect balance of automation combined with customisation, backed by a super attentive team. Can't recommend them highly enough.