The Complete Payments Platform for QuickBooks

Receive payments for your QuickBooks invoices easily with Pinch. No merchant account required. Store payment details and get paid automatically on the invoice due date.

How Pinch and QuickBooks work together

Pinch connects to your QuickBooks file in just a couple of minutes. Once connected you have the ability to collect payments from invoices on a once off or a repeating basis. Great for subscriptions or when your business receives repeat orders.

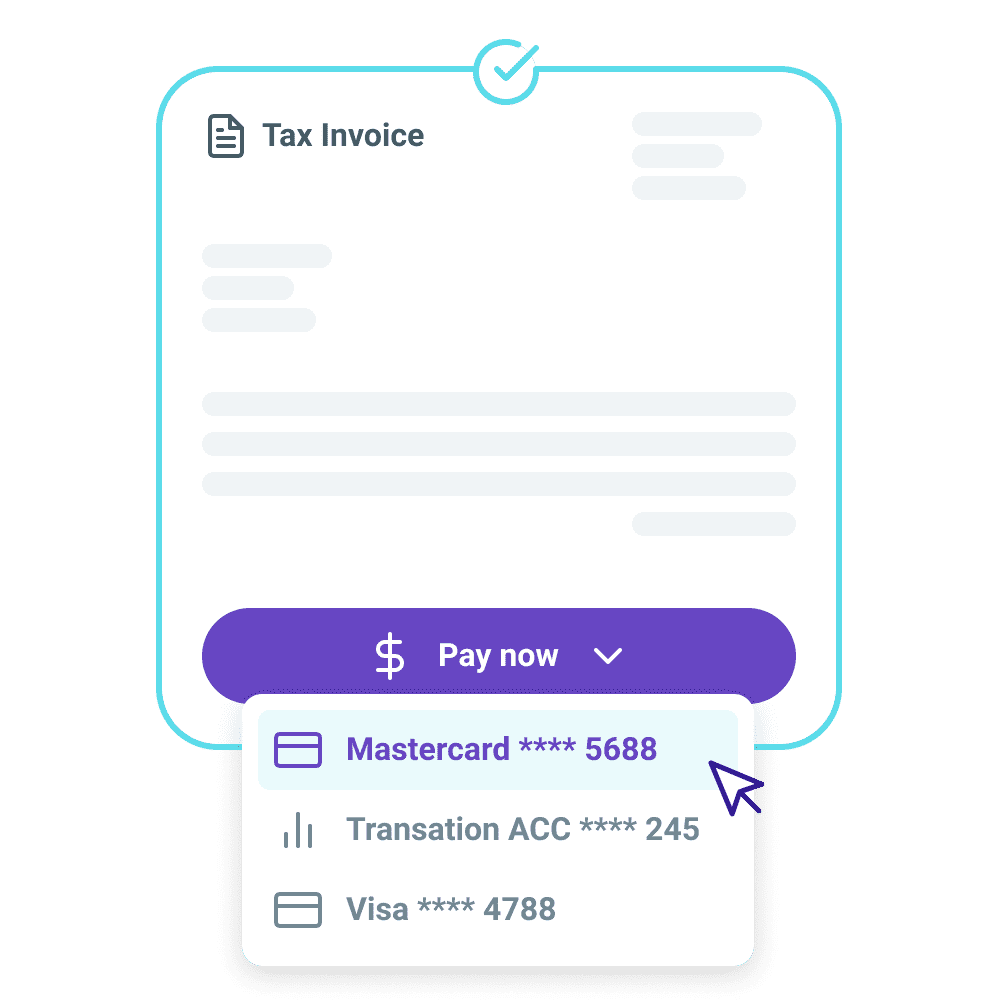

Get paid easily online

Pinch attaches a pay now link to each invoice created in QuickBooks. Your client can simply click a link from the email and securely pay you using their card or bank information.

We'll even mark the invoice in QuickBooks as paid straight away. Great if you have other QuickBooks addons.

Get paid automatically

Spend time chasing invoices each month from the same customers? Make that history with Pinch pre-approvals. A pre-approval means we will actively monitor QuickBooks invoices and automatically debit your customer on the invoice due date.

Don't worry if this sounds scary, you can limit what we will and won't debit automatically.

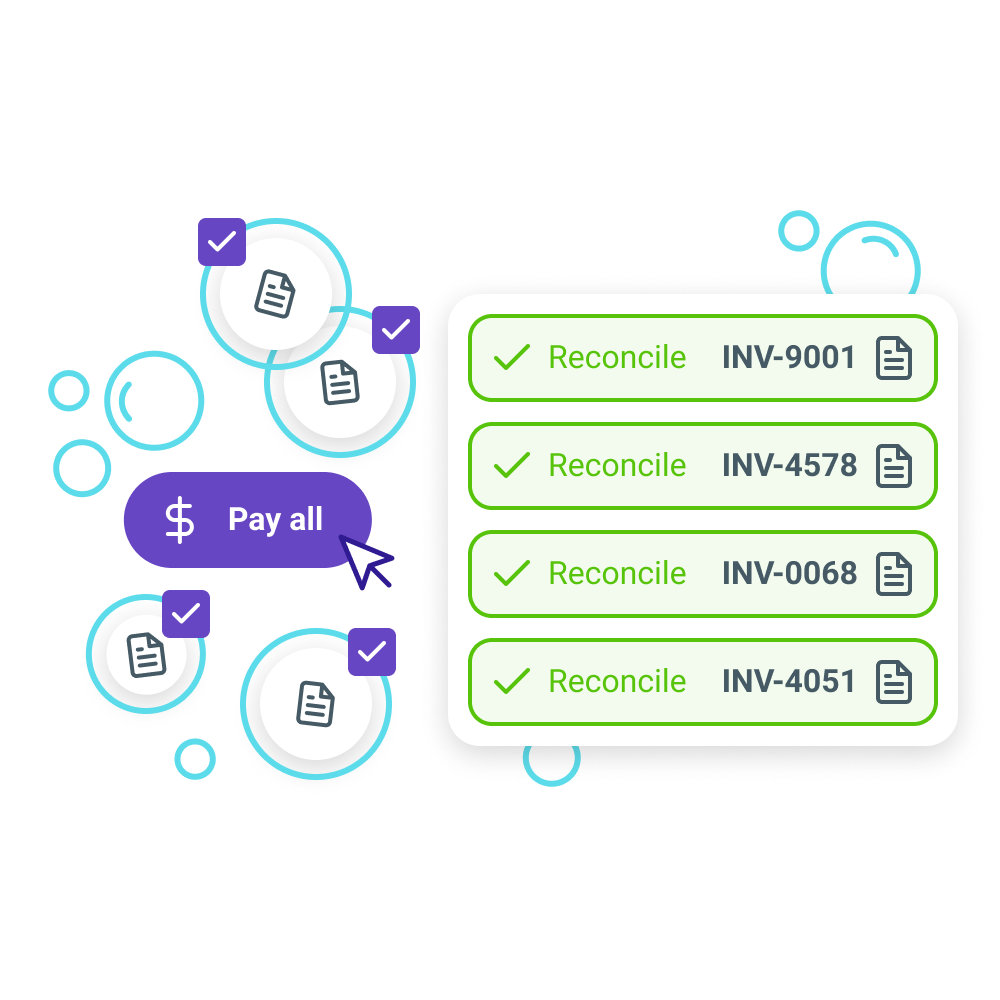

Full reconciliation

Some payment companies get you paid but don't reconcile the books. With Pinch, we are built as an invoice driven platform meaning we take care of everything including reconciling with your bank statement.

Process hundreds of invoices a month? This alone could give you your Friday afternoon back.

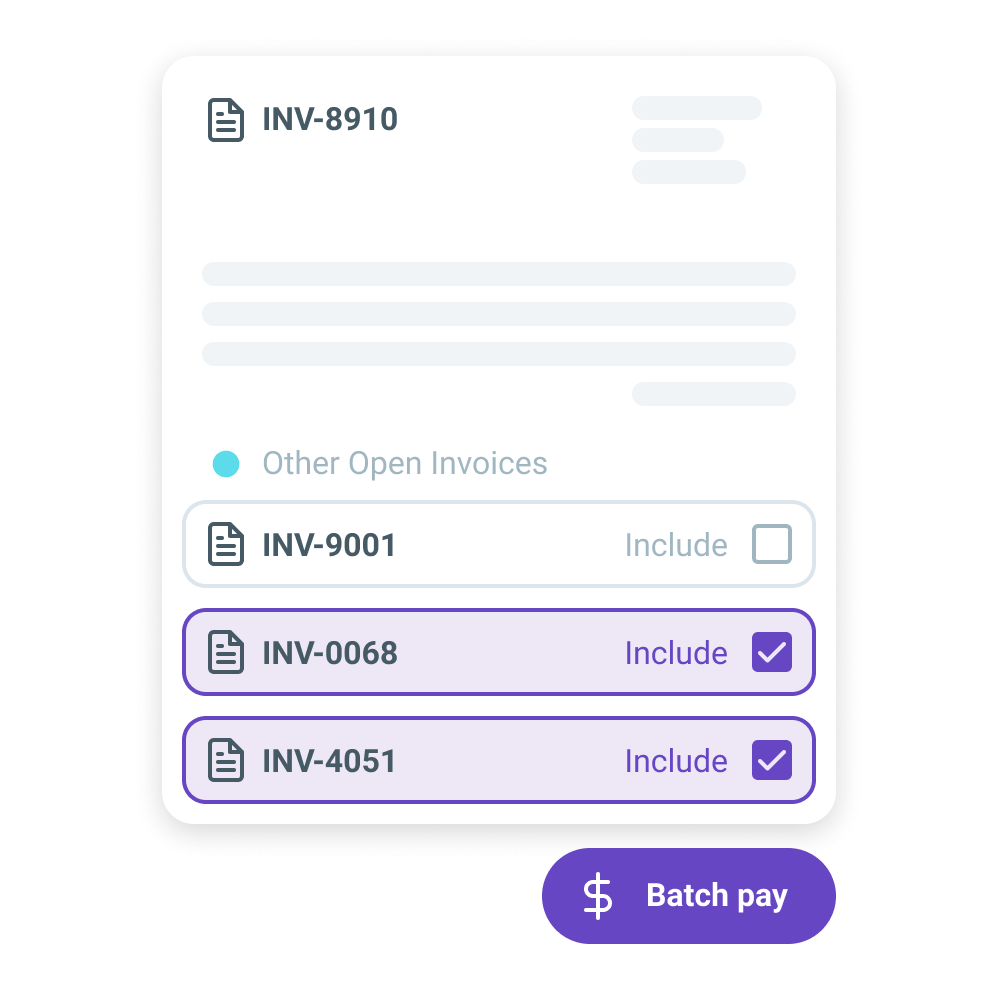

Batch payments

Give your customers the option to pay off multiple invoices with a single payment. Perfect for loyal customers who want to choose a time best for them to settle their account balance.

Each time you send an invoice, Pinch will scan your QuickBooks file and present other open invoices to be paid right from the pay now page.

See Pinch + QuickBooks in Action

This video walks you through the full experience of using Pinch with QuickBooks from setup to getting paid - so you can see exactly how it fits into your payment workflow.

Looking for instructions on how to connect?

Check out our step-by-step guide on how to connect your QuickBooks account to Pinch.

Why use Pinch with QuickBooks?

Unlock powerful features by connecting Pinch to QuickBooks.

Pay Now

Accept one-off credit card and direct debit payments online. Take one-off payments straight from the invoice using pay now.

Recurring payments

Get paid on the invoice due date. Set up regular automatic payments like subscriptions.

Variable Payments

We can collect any ad-hoc invoice amount automatically. Set thresholds to debit smaller amounts while leaving large amounts alone.

Payment plans

Breakdown large invoices into a series of smaller payments, all tracked on the one invoice.

Batch Payments

Recover aged invoices by showing all outstanding invoices available on the pay now page. The customer can pay all invoices at once in one payment.

On-charge Fees

You can choose to absorb the Pinch processing fees or optionally pass them onto your customer. We calculate the fee automatically and you can choose different options for different customers.

What else can Pinch do?

As the complete payments platform, you can take advantage of our full range of integrations.

HubSpot Sync

Sync key information from your QuickBooks file directly into your HubSpot contacts. See which contacts have overdue invoices, what they've been paying, and see a timeline of activity from Pinch.

Zapier

Create your own workflows using the Pinch Zapier integration. Useful for sending pre-approval forms directly from your own email account and reacting to customers who have added their payment information.

API Integration

Pinch was built API first, which means anything that you can do in our platform, you can also connect to directly using our API.

What our customers are saying

Take a read of what our customers are saying

on the QuickBooks Marketplace.

This streamlines accepting card and direct debit payments with the customer able to do the data entry for accepting payments and the software doing the data entry for the payment themselves. Have also just been informed they are working on automatically batching payments for a customer which will make it even cheaper to use.

Samuel Burmeister

This streamlines accepting card and direct debit payments with the customer able to do the data entry for accepting payments and the software doing the data entry for the payment themselves. Have also just been informed they are working on automatically batching payments for a customer which will make it even cheaper to use.

Samuel Burmeister

This streamlines accepting card and direct debit payments with the customer able to do the data entry for accepting payments and the software doing the data entry for the payment themselves. Have also just been informed they are working on automatically batching payments for a customer which will make it even cheaper to use.

Samuel Burmeister

We have been using Pinch for over a year and it has been just what our business needed. Easy to use, cost efficient and their customer service is on point. Keep up the great job, we appreciate your hard work and great product.

Dawn Hoskins

We have been using Pinch for over a year and it has been just what our business needed. Easy to use, cost efficient and their customer service is on point. Keep up the great job, we appreciate your hard work and great product.

Dawn Hoskins

We have been using Pinch for over a year and it has been just what our business needed. Easy to use, cost efficient and their customer service is on point. Keep up the great job, we appreciate your hard work and great product.

Dawn Hoskins

I was looking for an Aussie-based app for taking payments. Found Pinch, and it ticked all the right boxes. The guys that have developed this app are so easy to communicate with, and are so helpful!

Rob Murphy

I was looking for an Aussie-based app for taking payments. Found Pinch, and it ticked all the right boxes. The guys that have developed this app are so easy to communicate with, and are so helpful!

Rob Murphy

I was looking for an Aussie-based app for taking payments. Found Pinch, and it ticked all the right boxes. The guys that have developed this app are so easy to communicate with, and are so helpful!

Rob Murphy

Get Started

Stop chasing smaller payments and automate collection using Pinch.