The following post was written in collaboration with SMB Consultants.

In the fast-paced world of small to medium businesses (SMBs), every minute counts. Cash flow is the lifeblood of your operations, yet so many business owners find themselves caught up in the never-ending cycle of chasing payments. If you’re still relying on traditional methods like manual invoicing and follow-up calls, it’s time for a change. Enter Pinch Payments.

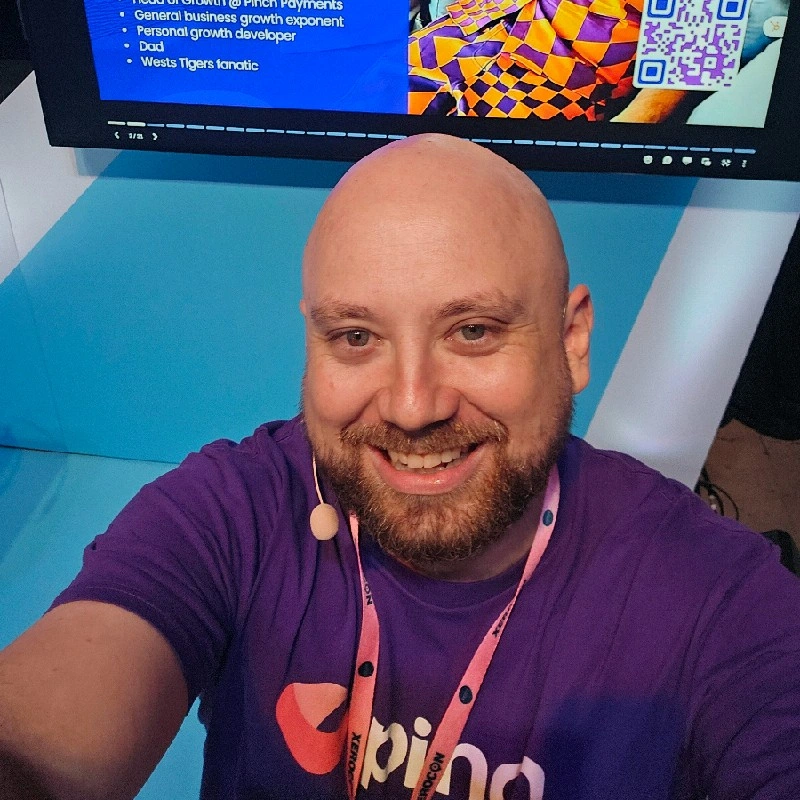

Meet SMB Consultants

At SMB Consultants, they live and breathe inventory management. Led by their CEO, Jeffrey Atizado, they’ve spent over 14 years helping businesses like yours streamline operations with cutting-edge digital solutions. Their mission? To turn your business into a digital-first powerhouse ready for growth and scalability.

Why Chasing Payments is a Nightmare

“Chasing payments is not a fun thing. No one likes to do it,” says Jeffrey. “It gets pushed to the bottom of the list and becomes a compounding problem.”

Here’s what makes traditional payment methods a hassle:

- Time-Consuming and Labor-Intensive: Manually tracking down payments eats up hours that could be spent on more important tasks.

- High Risk of Late or Missed Payments: Delayed payments can mess up your cash flow, making it hard to manage expenses and plan for growth.

- Negative Impact on Cash Flow: Inconsistent cash flow can lead to financial instability, affecting everything from payroll to inventory purchases.

- Strain on Customer Relationships: Persistent follow-ups can annoy customers, potentially leading to dissatisfaction and loss of business.

Ultimately, these outdated methods can hinder your business growth, making it crucial to find a more efficient solution.

Why Old-School Methods Just Don’t Cut It Anymore

In today’s business climate, relying on outdated payment collection methods is a recipe for disaster. Here’s why:

- Inefficiency of Traditional Methods: Manual processes are slow and error-prone. Automation is the key to efficiency.

- Missed Opportunities: Time spent chasing payments is time not spent on growing your business. Imagine what you could achieve with that extra time.

- Stress and Uncertainty: Unpredictable cash flow creates stress and hampers effective business planning.

- Resource Drain: Your team’s time is valuable. Don’t waste it on chasing payments.

- Poor Customer Experience: No one likes to be nagged. A seamless payment process keeps your customers happy.

- Financial Instability: Inconsistent cash flow can put your business in a tough spot, especially during economic downturns.

The inefficiencies and frustrations of chasing payments can seriously hinder your business growth. It’s time to ditch the old methods and embrace a smarter solution.

The Pinch Payments Advantage

So, what’s the solution? Pinch Payments of course. Here’s how it can revolutionize your business:

- Automated Payment Collection: Say goodbye to manual follow-ups. Pinch Payments automates the entire process, saving you time and reducing administrative headaches.

- Improved Cash Flow: With timely and predictable payments, you can manage your cash flow more effectively and plan for the future.

- Enhanced Customer Experience: Offering seamless and convenient payment options keeps your customers happy and loyal.

- Security and Reliability: Pinch Payments offers top-notch security features that protect both your business and your customers.

SMB Consultants’ Success Story with Pinch Payments

Let’s talk results. After SMB Consultants implemented Pinch Payments, the transformation was incredible.

The Challenge: They were bogged down by manual invoicing and follow-ups, which led to delayed payments and disrupted cash flow.

The Solution: Pinch Payments took over, automating their entire payment collection process.

The Results:

- Elimination of Manual Accounts Receivables Management: Automation freed up valuable time and resources.

- Improved Cash Flow and Financial Predictability: Timely payments ensured consistent cash flow, making financial planning a breeze.

- Increased Efficiency and Productivity: With less time spent chasing payments, we could focus on core business activities.

- Positive Feedback from Clients: Our clients loved the seamless and convenient payment options.

“We went from a business that had a debtor problem to one that doesn’t have a debtor problem at all,” says Jeffrey. “Pinch has allowed us to forecast, navigate cash flow during slow periods, and guarantee with accuracy when cash flow is coming in.”

The experience for our most heavy adopters, like SMB Consultants, is that their payers actually prefer automated payments once they get used to it. It removes the hassle and awkwardness of chasing payments.

Ready to Transform Your Payment Processes?

Chasing payments is a thing of the past. In today’s competitive landscape, SMBs need efficient, reliable, and automated payment solutions to thrive. Pinch Payments offers a modern approach that not only improves cash flow but also enhances customer satisfaction and overall business productivity.

Don’t let outdated payment collection methods hold you back. Talk to SMB Consultants today to implement Pinch Payments into your omni-channel inventory management business and say goodbye to chasing payments. Focus on what truly matters—growing your business.